An X-ray of Grand Rapids Hospital Retirement Plans: Which One is Best?

/Employer Retirement Plan Details: Why Should You Care?

Employer retirement plans — such as 403(b)s and 401(k)s — are usually a large part of the financial plan for providers, nurses, and other medical professionals. The details of these plans can be confusing so I thought it would be helpful to compare and contrast the plans of the four larger hospitals in Grand Rapids, MI for you.

Understanding the details of your employer plan can lead to a huge difference in your account value at retirement. It should also be factored in when deciding where to work, as it is part of your compensation package. Different aspects of these plans can make them better or worse, I will assign them a Heath Biller score ranging from 0 to 10 — since that is the range used for pain assessments. 10 will be excellent and 0 will be horrible. Let’s X-ray the plans.

*Full disclosure, I have previously worked at Corewell Health & Mary Free Bed

Eligibility

This is when you are allowed to start participating in your company’s retirement plan. Due to compounding interest, the sooner you can start participating the better.

Automatic Deferral

This is when a company automatically enrolls you into the plan at a certain contribution rate when you get hired. The other option is having you opt into the plan yourself, which sometimes doesn’t happen. Automatic deferral is usually much better since it helps you start investing sooner. Life can get busy and procrastination is real.

Employer Matching Contributions

This is the amount of money that your employer contributes to your account on your behalf. It can be matching contributions which is usually a percentage of what you contribute. They can also make a non-elective contribution which means they contribute money to your account even if you don’t contribute anything. A higher rate here is better since that is more money towards your account.

Vesting Schedule

This is the length of time you have to stay working at the company before you are eligible for their matching contributions. If you leave the company before this period of time, they will take their matching contributions back from your account. The shorter the vesting schedule the better.

Roth Option

For a long time, most companies only offered Traditional contributions as an option for their plans. This means you get a tax deduction now but will have to pay taxes down the road when you take the money out. More companies are now offering a Roth contribution option. This means you do not get a tax deduction now but when you take the money out down the road, it will be tax-free. Sometimes Traditional contributions are better and sometimes Roth contributions are better. Having a Roth option is beneficial as it allows flexibility for your specific situation. If you want to learn more about Traditional vs. Roth contributions, read this blog post.

Plan Fees

These are the fees charged to your retirement account by the plan providers for helping set up and manage the retirement plan. Lower fees here mean less money is coming out of your account.

Investment Options

These are the range of investment options the plan offers inside the account. You want to make sure you are contributing to your account, but you also want to be aware of how the money is invested inside your account.

And the Winner is…

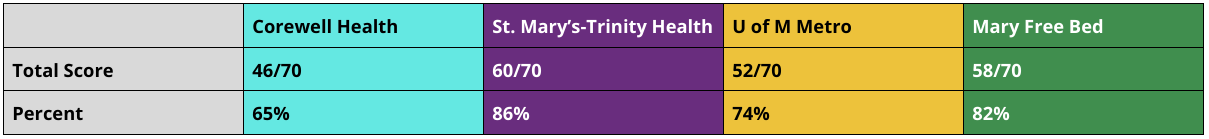

Saint Mary’s-Trinity Health with a score of 60/70 (86%). The aspects of their plan that stood out the most compared to the competition were: their employer contribution, their plan fees, and their investment options.

The other plans are pretty good, I have seen much worse. I would have liked to have seen more automatic deferrals, higher employer matching contributions, and more target date funds as the default investment option. Hopefully, this has helped you better understand the plan where you work or evaluate the plans of future employers you are considering.

Please reach out if:

You work for one of these hospitals and have more questions about your plan and what you are invested in

You work for a different medical facility and would like me to help you review the retirement plan they offer

You work for a facility that currently does not offer a retirement plan but would like help setting one up

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third-party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.